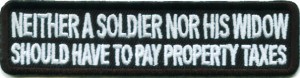

How do you feel about the following statement: "neither a soldier nor his widow should have to pay property taxes". I ask because I saw that statement on the Soldier Nor His Widow patch at The Cheap Place. If you want to see it yourself you can find it in the Military Patches section. Anyway, it got my attention due to the fact that when I began to think about it, I discovered I that simultaneously agreed and disagreed with the idea. How can that be? Let me explain.

How do you feel about the following statement: "neither a soldier nor his widow should have to pay property taxes". I ask because I saw that statement on the Soldier Nor His Widow patch at The Cheap Place. If you want to see it yourself you can find it in the Military Patches section. Anyway, it got my attention due to the fact that when I began to think about it, I discovered I that simultaneously agreed and disagreed with the idea. How can that be? Let me explain.

While I do agree that soldiers and their widows should be exempt from certain kinds of taxes, I'm not so sure that property tax is the way to go. Property tax is the domain of the county government, not the federal government. It would seem that as a federal employee, the taxes a soldier and his widow should be exempt from would be federal taxes. It would be a greater amount of money anyway if the exemption were applied to all federal taxes including income tax, Social Security withholding, and all the federal fees placed on everything from gasoline to utilities. I know - it would be complicated to administer such a broad tax exemption, but it's worth it.

I guess what I'm saying is that I agree with what the patch says in principle. I just think that tax break should be at the federal level rather than state or local. What do you think?